Coordinated by Drs. Gabrielle Magnant and Chloé Choukroune.

Provident funds, insurance, BNC, SELARL, SPFPL, purchase, creation, valuation, association, sale, retirement, all the answers to your questions.

Virginie DAVION – Lawyer

Partner at JOFFE & COLLABORATEURS – TAX

20 years of experience in wealth and corporate taxation. Virginie regularly advises a clientele of doctors on structuring their activity in the form of companies.

Charlotte VIANDAZ – Lawyer

Advice from the firm JOFFE & COLABORATEURS – CORPORATE

With 10 years of experience in corporate and business law, Charlotte advises French and international companies, managers, and professionals (doctors, dentists, orthodontists, etc.) on all matters relating to corporate law

Presentation of the SYDEL firm

Sydel, the family office for healthcare professionals, organizes training courses and conferences and supports you daily on all your professional & personal strategies: financial, legal and tax optimization of your SELARL/SPFPL/SMHF up to the transfer of your business.

Summary

Converting to a SELARL (Société d'Exercice Libéral à Responsabilité Limitée) is an important first step in managing one's remuneration, and therefore one's income tax and social security contributions. This implies the capitalization of one's cash reserves within the SELARL.

But how and when can you best access this cash within your personal assets, taking into account your objectives: to carry out a personal project, to prepare for retirement with supplementary income, or to facilitate its transfer to your children?

To benefit from preferential rates as a member, DU , internal, you must be up to date with your membership fee.

DATE:

January 15, 2024

PRICES:

Including lunch

SBR Member €240*

Non-SBR Member €360

DU / CISCO / CEFOB €50*

DESODF Intern free (without meal)

Member, DU, Intern up to date with their SBR membership.

LOCATION:

Arts et Métiers Exhibition Center,

9 bis avenue d'Iéna – 75116 Paris

Metro: Iéna – line 9 – Iéna Musée Guimet exit

Buses: 32 – 63

Kléber car park – 65 av. Kléber 75116 Paris

ORGANIZER:

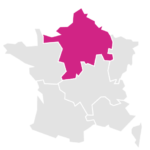

SBR – ILE DE FRANCE

Contact:

Dr. Gabrielle Magnant

sbr-idf@bioprog.com

JOFFE LAW FIRM AND ASSOCIATES: Virginie DAVION – Charlotte VIANDAZ

Topics covered:

• Structuring the business in the form of companies (SELARL, SELAS) and setting up holding companies (SPFPL, …)

• Legal, asset and tax implications: Points to consider and constraints

• The role of real estate in the scheme

• Impact of the reform of healthcare professional societies since the ordinance of February 8, 2023

• Necessary validation by the Order of Orthodontists of the legal structures

Break

Dr. Nicolas Goossens

We will discuss the different modes of practice, ways to surround oneself, the management of employees' working time and above all we will answer as many of your questions as possible, which will all be useful to everyone.

Lunch*

SYDEL OFFICES

Topics addressed by the Sydel firm in cooperation with the Joffe firm:

• The benefits of cash capitalization in a SELARL (limited liability company for liberal professions)

• How and when to recover the funds from one's SELARL/SELAS/SPFPL into one's personal assets

• How to optimize the acquisition of the office premises.

• Consequences of VAT on alignments.

• Double social security contributions for salaried partners of SEL.

• Increased controls on the valuation of SEL shares during acquisition by SPFPLs.

Break

SPEED DATING

Are you looking for a firm, an associate, a partner, or a successor? We will put you in touch!